Stop Paying to Pay—Use GhanaPay Instead

GhanaPay: Mobile Money with Zero Fees

It all started when a colleague said, “Just dial *707#,” and suddenly, the entire office was buzzing. Why? Because with GhanaPay, sending money comes with zero transaction charges. Imagine transferring money to your grandmother in the village or paying your Bolt driver in Accra—without losing a single cedi in fees.

For Ama, a university student managing a tight budget, using GhanaPay has made everyday transactions a lot easier. it’s been a welcome change. Before GhanaPay, my mum always had to factor in transfer charges when sending money to her suppliers,” a colleague shared. “Now, it’s free—and that little difference adds up and helps her business.

GhanaPay isn’t just another mobile wallet. It’s a game-changer for everyday Ghanaians students, farmers, drivers, traders—who need a simple, secure, and cost-free way to send and receive money. With zero transaction fees, GhanaPay is making digital finance truly accessible to all.

But the app is more than just easy and affordable. It’s backed by trusted, regulated banks, ensuring users are protected. That trust matters especially for Ghanaians in rural areas who sometimes are unable to access traditional banking systems.

No bank nearby? No problem. GhanaPay bridges the gap, bringing financial services to those who need them most. Whether it’s a tomato seller in Tamale or a pensioner in Takoradi, the app is built for everyone, with a user-friendly design that makes sending money simple even for first-time users.

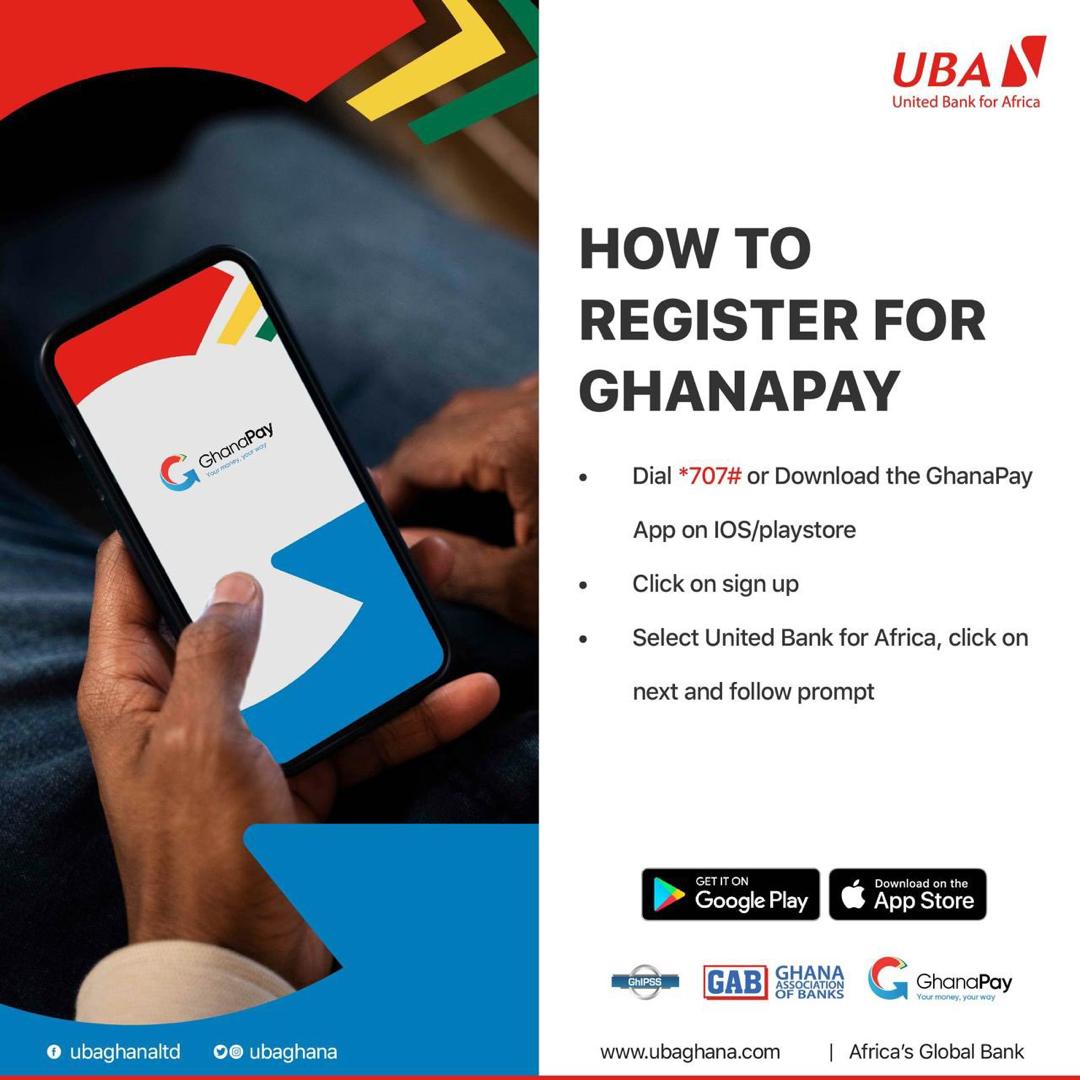

Getting started is easy:

Download the GhanaPay app or dial *707#

Select UBA as your preferred bank if using the app

Register with your Ghana Card

Start making free transfers and secure payments—with peace of mind

Enjoy a bouquet of services on GhanaPay Mobile Money, which offers great value for money:

Free statements of account

Free cash withdrawals at all bank branches

Free transfers to all banks

Earn quarterly statutory interest of 1.5%, and up to 5% on savings

The benefits go on and the impact is real.

With GhanaPay’s mission to drive financial inclusion by simplifying digital payments, it’s more than just a mobile wallet. GhanaPay is connecting Ghana digitally, removing barriers like transaction fees, and making it easier for businesses and consumers alike to thrive. By supporting seamless, cost-free transfers, GhanaPay empowers individuals and enterprises across the country to participate fully in the economy.

Beyond convenience, GhanaPay is part of a bigger story a movement to strengthen Ghana’s financial independence. Every time you use GhanaPay, you’re keeping money in Ghana’s economy and investing in a system that works for all of us.